Everything you need to know about “Credit Score” in the UK

Useful information for newcomers to the UK who need to build their credit history

What is a Credit Score?

Many countries in the world are now implementing a kind of credit score system to evaluate citizens’ financial behavior in order to provide them with better and fair credit offers.

According to Wikipedia:

A credit score is a numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus.

Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. The use of credit or identity scoring prior to authorizing access or granting credit is an implementation of a trusted system.

Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers.

Credit Score in the UK

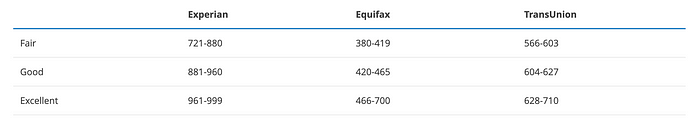

Credit score calculation is different from country to country and even from one credit agency to another in the same country. In some countries like the UK, different credit agencies have their own methods of calculation as well as their own bands and numbers.

Three credit agencies in the UK are Equifax, Experian, and TransUnion.

- Experian score ranges between 0 and 999.

- Equifax score ranges between 0 and 700.

- TransUnion score ranges between 0 and 710

Any score less than 721 (Experian), 380 (Equifax), or 566 (TransUnion) is considered “Poor” which indicates you

- have had bad credit.

- or don’t have enough credit history (less than 1 year or so)

If your credit score is poor, you’re unlikely to get any credit from lenders (a credit card, a loan, a mortgage, etc.)

How to check your credit score in the UK?

All three credit agencies have their own websites and/or work with some partners to allow you to check your credit score:

- Experian users its own website and apps.

- ClearScore is Equifax’s partner.

- CreditKarma is TransUnion’s partner.

If you have recently moved to the UK from abroad you may not be able to open an account with all or some of these providers to check your score; that’s because they need your address history for the past 1~3 years (this varies from one agency to another too) to be able to generate your credit report. That’s the bad news but the good news is you can get your credit score (report) though some companies that offer credit cards specially designed to build credit. As an example, if you get a credit card from Aqua, you can get your credit report in their app or on their partner’s website.

What are the factors affecting your credit scores?

There are various factors that will positively or negatively affect your credit score; the important thing as a newcomer to the UK is that your score is poor at the beginning and you need to build it, so it’s the chicken or the egg dilemma! You need to have a credit card to build your credit history but you usually need a minimum score to get a credit card! So what’s the solution?

There are a few credit card providers in the UK that offers “credit building” credit cards to let you build your credit little by little. As I said above, Aqua is one of them and CapitalOne is another. They usually give you a credit card with a small credit limit like £300 pounds. Three important things that will help you build your credit history using a credit builder card are:

- Never spend more than 25% of your credit each month.

- Always pay back the statement in full.

- Ask your credit card company to increase your credit limit after a few months (usually between 4 to 6 months)

- Get a mortgage. Yes, this can improve your credit score!

This will help you increase your credit score gradually that will also help you become eligible for other types of credit cards and loans (and a mortgage in the future)

Some factors also negatively affect your score that you should seriously avoid:

- Going below 1% or over 25% of your total credit limit spend or even worse over your total credit limit and going negative.

- Opening too many credit accounts (like credit cards, bank accounts, mobile accounts, broadband accounts, loans and etc.) in less than 6 months.

- Not being on the electoral vote list. This one is out of your control unless you’re a British citizen and can register to vote; so wait it out!

- Cash Advance! This is taking cash from your credit cards but it’s not just limited to use an ARM to get cash. If you use a credit card to top up another account, buy cryptocurrencies, pay for bet and gambling; they are all considered as cash advance and will negatively impact your credit score.

- Hard Search! Every hard search (that usually appears on your credit file when you apply for a credit (e.g. loan, a new credit card, …) will reduce your credit score and it usually takes a few months to go up again.

Not all your scores across those agencies are the same or increase/decrease at the same pace; that’s the reason you might notice that your score with TransUnion is good or excellent and at the same time is poor with Experian; this is because you need to get your reports from all of them so they start to keep track of your record.

Which lenders work with which credit agencies in the UK?

Whenever you want to get a loan or credit card, start a new mobile or broadband contract, or start a mortgage, the other party will check your credit report with one of the three agencies mentioned above. So, if you want to apply for credit, you need to check which agency they will do a credit check with and how likely you’re to be accepted or rejected; why is this important? If a hard search on your credit history shows a record of rejection, it will negatively affect your score. What is a “credit check” and the difference between a “soft” and “hard” credit check? Here’s a good article by HSBC explaining this.

Here’s another good article explaining which credit agencies lenders in the UK use. It’s important to pick your lender wisely according to your credit score across different agencies to increase your chance to be accepted.

Building credit is not happening overnight and you will need between 1–3 years to improve it but the hints I introduced in this post can help you shorten this time and take this journey with more confidence.

Credit Boosters

There are also some services that help you boost and build your credit not only by giving you a credit card.

One of them is CreditLadder where you can sign up (free plan available too) and they will report your on-time rent payments to credit agencies to boost your credit score. CreditLadder currently reports to Equifax and Expersian (you can report to one only if you’re on the free plan).